An accident can throw your life into chaos. Dealing with the aftermath, especially the claim process with your insurance company, can feel overwhelming. But don’t worry, you can navigate this. This guide gives you a step-by-step approach to getting a fair settlement after a car accident.

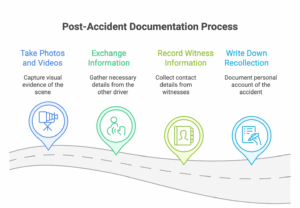

1. Document the Accident Scene: Protecting Your Claim

The moments after an accident are crucial. Think of yourself as a detective gathering evidence.

- Take photos and videos: Capture everything – vehicle damage, license plates, street signs, traffic signals, and any visible injuries. Don’t assume the police report will capture it all.

- Exchange information: Get the other driver’s name, address, phone number, insurance details, and driver’s license number. Verify that the insurance card is valid and current.

- Record witness information: If there are witnesses, get their names and contact information. Their accounts can be invaluable.

- Write it all down: As soon as possible, jot down your recollection of the accident. Include details you might forget later, like the weather conditions or the other driver’s demeanour.

Example: A client who meticulously photographed the accident scene, including the lack of skid marks from the other driver, proved the driver was not paying attention and therefore liable. This evidence helped refute the insurance company’s initial denial of the claim.

2. Notify Your Insurance Company Promptly: Start Your Accident Claim Right

Contact your insurance company as soon as you can after the accident. Most policies have strict reporting deadlines (often within 24-72 hours). Stick to the facts when reporting the accident. Avoid speculation or admitting fault, even if you think you might be partially responsible. It’s their job to investigate.

Example: A driver said “I’m so sorry, I didn’t see you” after a fender-bender. The insurance company used that statement as evidence of fault, even though the other driver was speeding.

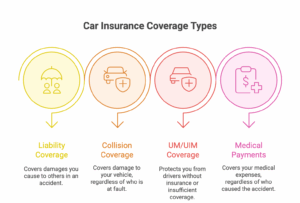

3. Understand Your Insurance Policy and Coverage Options

Before diving into the claim process, understand what your insurance covers. Carefully review your policy. Pay close attention to:

- Liability coverage: This covers damages you cause to others.

- Collision coverage: This covers damage to your vehicle, regardless of fault (subject to your deductible).

- Uninsured/Underinsured Motorist (UM/UIM) coverage: This protects you if you’re hit by someone without insurance or with insufficient coverage.

- Medical Payments (MedPay): This covers your medical expenses, regardless of fault.

Knowing your coverage limits and deductibles will help you estimate potential settlements.

4. Gather Evidence to Support Your Accident Claim and Strengthen Your Position Against the Insurance Company

Don’t rely solely on the insurance company’s investigation. Gather your own evidence to strengthen your claim:

- Police report: Obtain a copy of the official police report.

- Medical records: Keep detailed records of all medical treatments, diagnoses, and expenses.

- Lost wage documentation: Collect pay stubs, tax returns, or a letter from your employer to prove lost income due to the accident.

- Repair estimates: Get multiple estimates for vehicle repairs.

- Keep a detailed log: Write down all communications with the insurance company, including dates, times, and the names of representatives.

5. Negotiate with the Insurance Company for a Fair Settlement: Know Your Worth

The insurance company’s initial offer is often lower than what you deserve. Don’t accept the first offer without careful consideration. They are a business, after all. You can negotiate.

- Understand the types of damages: You can claim both economic damages (medical bills, lost wages, property damage) and non-economic damages (pain and suffering, emotional distress).

- Document your pain: Keep a journal detailing your pain levels, limitations, and emotional impact of the accident. This is crucial for calculating non-economic damages.

- Be prepared to counteroffer: Research the value of similar claims in your area.

- Stay calm and professional: Even if frustrated, maintain a respectful tone during negotiations.

Example: A person was offered $5,000 for a whiplash injury. They declined, highlighting their ongoing physical therapy, missed work, and the daily pain they endured. They eventually secured a $15,000 settlement.

6. Seek Legal Counsel: When to Fight Back Against the Insurance Company’s Accident Claim Decision

Sometimes, despite your best efforts, the insurance company refuses to offer a fair settlement. Consider consulting with an accident attorney if:

- You’ve suffered serious injuries.

- The insurance company denies your claim or offers a lowball settlement.

- Liability is disputed.

- You’re unsure about your legal rights.

An attorney can handle communications with the insurance company, protecting you from manipulative tactics and ensuring your rights are protected. They understand state-specific laws and regulations impacting insurance claims, such as comparative negligence rules. The attorney will know how to avoid mistakes.

Remember, the goal is a fair settlement. By documenting the accident, understanding your policy, gathering evidence, and negotiating effectively (or seeking legal help), you can turn that wreck into a check.