Insurance. You pay your premiums, hoping you’ll never need it. But when life throws you a curveball, understanding your insurance claim rights becomes crucial. This isn’t just about getting money; it’s about getting what you’re owed and being treated fairly. Let’s break down what you need to know to protect yourself.

1. Understanding Your Insurance Policy and Claim Rights

Your insurance policy is a contract. It outlines what’s covered, what’s excluded, and your responsibilities. Take time to read it! Don’t wait for a crisis. Pay close attention to:

- Coverage Limits: The maximum amount the insurance company will pay.

- Deductibles: What you pay out-of-pocket before coverage kicks in.

- Exclusions: Specific events or items not covered. For example, many homeowner’s policies exclude flood damage unless you have separate flood insurance.

- Conditions: Requirements you must meet, like filing a police report after a theft.

Your rights stem directly from this contract, as well as from state laws designed to protect consumers. These laws often dictate how quickly an insurance company must respond to a claim and how it must conduct its investigation.

2. Filing a Claim: Step-by-Step Guide and Your Responsibilities

Filing a claim can feel overwhelming, but following these steps can help:

- Report the Incident Promptly: Most policies require you to report incidents quickly. Check your policy for specific timelines.

- Document Everything: Take photos, videos, and notes. Preserve any damaged property if possible.

- Complete the Claim Form Accurately: Provide all requested information truthfully and completely.

- Cooperate with the Insurance Company: This includes answering questions and providing requested documents. However, you’re not obligated to agree to anything without carefully considering it.

- Keep Records: Save copies of all correspondence, documents, and photos related to your claim.

You’re responsible for providing accurate information and cooperating with the insurance company‘s investigation.

3. The Insurance Claim Process: From Investigation to Settlement

After you file, the insurance company will conduct an investigation. This might involve:

- Reviewing your policy.

- Interviewing you and witnesses.

- Inspecting the damage.

- Consulting with experts (adjusters, contractors, etc.).

The insurance company must conduct a reasonable and thorough investigation. They can’t just deny your claim without a valid reason. If the claim is approved, they’ll offer a settlement. You have the right to negotiate this settlement. If you disagree with the offer, don’t be afraid to counter with your own assessment and supporting documentation.

4. What To Do If Your Insurance Claim Is Denied: Exercising Your Rights

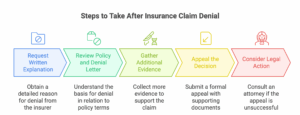

Claim denial is frustrating, but it’s not the end of the road. Here’s what to do:

- Request a Written Explanation: The insurance company must provide a written explanation of why your claim was denied.

- Review Your Policy and the Denial Letter: Understand the basis for the denial. Does it align with your policy’s terms and conditions?

- Gather Additional Evidence: If the denial is based on insufficient evidence, gather more to support your claim.

- Appeal the Decision: Most policies have an appeals process. Follow the instructions in your policy. This often involves submitting a written appeal with supporting documentation.

- Consider Legal Action: If the appeal is unsuccessful, or if you believe the insurance company acted in bad faith, you may want to consult with an attorney.

Appeals processes vary by state. In California, for instance, the Department of Insurance can mediate disputes. In Texas, you have the right to sue the insurance company for breach of contract and bad faith.

5. Common Insurance Claim Issues and How to Avoid Them

- Underinsurance: Not having enough coverage to replace damaged property. Regularly review your coverage limits.

- Disputes over Value: Disagreements on the cost of repairs or replacement. Get multiple estimates.

- Bad Faith Practices: Unfair or deceptive practices by the insurance company.

- Example: Unreasonable delays, lowball offers, or denying a valid claim without proper investigation. Case Study: In 2021, a Florida homeowner successfully sued their insurer for bad faith after their hurricane claim was unreasonably delayed for over a year, leading to further damage.

- Policy Interpretation: Disagreements on what the policy covers. Seek clarification from the insurance company or an attorney.

6. Protecting Your Insurance Claim Rights: Documentation and Communication

Meticulous record-keeping is your best defence.

- Document all communication: Keep records of phone calls, emails, and letters.

- Get everything in writing: Avoid relying on verbal agreements.

- Be polite but firm: Advocate for your rights without being aggressive.

7. Resources for Policyholders: Navigating Insurance Disputes

Don’t feel like you’re alone in this. Several resources can help:

- State Insurance Regulators: Each state has a department of insurance that regulates insurance companies and investigates complaints.

- Consumer Protection Agencies: These agencies offer assistance with consumer disputes, including insurance claims.

- Attorneys Specialising in Insurance Claims: An attorney can review your policy, advise you on your rights, and represent you in negotiations or litigation. Choosing an attorney with experience in insurance claims is crucial. Look for someone who offers free consultations and works on a contingency fee basis (they only get paid if you win). Organisations like the American Association for Justice can help you find qualified attorneys.

Understanding your insurance claim rights is vital. By being informed and proactive, you can increase your chances of a fair and successful resolution.