Accidents happen. Despite our best efforts, life can throw unexpected curveballs, often in the form of a car crash, a slip-and-fall, or a workplace mishap. While no one can predict the future, you can prepare for the financial aftermath with accident insurance. Let’s explore what it is, why you need it, and how to get the most out of it.

Understanding Accident Insurance: What is it and How Does it Work?

Accident insurance is a type of supplemental insurance policy that pays you a cash benefit if you experience an injury due to an accident. Unlike health insurance, which covers medical bills, accident insurance provides a lump sum payment that you can use for any purpose. This includes deductibles, co-pays, rent, groceries, childcare, or any other expense you incur as a result of the incident.

Think of it as a financial safety net specifically designed for accidental injuries. You pay a monthly or annual premium, and in return, the policy outlines specific covered incidents and their corresponding payouts. For example, a policy might pay $500 for a concussion, $1,000 for a fracture, or $5,000 for hospitalization due to an accident.

The payout is in addition to any other insurance you have, such as health insurance or auto insurance. This is key because those policies often don’t cover all expenses, especially indirect costs.

Why You Need Accident Insurance After a Crash

The true cost of an accident often extends far beyond medical bills. Consider a scenario: Sarah is rear-ended while driving home from work. Her car needs repairs, she has a broken wrist, and she can’t work for six weeks. Her health insurance covers her medical treatment, and her auto insurance covers the car repair. But what about the lost wages? What about the cost of hiring someone to help with chores around the house while her wrist heals? This is where accident insurance steps in.

Many people don’t realize how quickly expenses pile up. According to the National Safety Council, the average cost of a medically consulted motor vehicle injury was $113,000 in 2022. That includes lost wages, medical expenses, property damage, and employer costs. Accident insurance can help bridge that gap, providing crucial financial support during a difficult time.

Furthermore, the stress of dealing with medical bills and lost income can significantly impact mental health. Recent studies show a strong correlation between financial strain following an accident and increased rates of anxiety and depression. Having accident insurance can alleviate some of this financial stress, allowing you to focus on recovery.

Key Features and Benefits of Accident Insurance

- Cash Benefit: Direct payment you can use as you see fit.

- Supplemental Coverage: Works alongside your existing insurance.

- Wide Range of Coverage: Policies typically cover a variety of injuries.

- Affordable Premiums: Generally less expensive than comprehensive health insurance.

- Peace of Mind: Knowing you have a financial safety net.

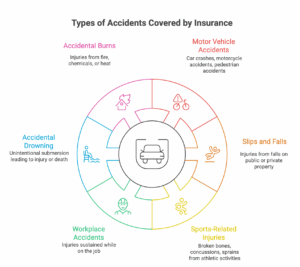

Types of Accidents Covered by Insurance Policies

The specific accidents covered vary from policy to policy, but common examples include:

- Motor Vehicle Accidents: Car crashes, motorcycle accidents, pedestrian accidents.

- Slips and Falls: Injuries sustained from falls on public or private property.

- Sports-Related Injuries: Broken bones, concussions, sprains from athletic activities.

- Workplace Accidents: Injuries sustained while on the job.

- Accidental Drowning

- Accidental Burns

It’s crucial to carefully read the policy details to understand what is covered and what is excluded. Pay close attention to definitions. For example, some policies might define “accident” in a way that excludes injuries caused by pre-existing conditions or illnesses.

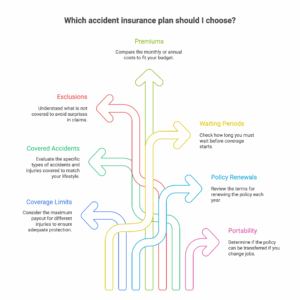

Comparing Accident Insurance Plans: Finding the Right Fit

Choosing the right accident insurance plan requires careful consideration. Key factors to compare include:

- Coverage Limits: The maximum amount the policy will pay out for different injuries.

- Covered Accidents: The specific types of accidents and injuries covered.

- Exclusions: The situations and injuries not covered by the policy. Look for fine print regarding pre-existing conditions or activities deemed “high risk.”

- Premiums: The monthly or annual cost of the policy.

- Waiting Periods: The time you have to wait after purchasing the policy before coverage begins.

- Policy Renewals: The terms and conditions for renewing your policy each year.

- Portability: Can the policy be transferred if you change jobs?

Don’t hesitate to shop around and compare quotes from multiple insurance companies. Websites like NerdWallet and ValuePenguin offer useful tools for comparing accident insurance plans.

Filing a Claim and Maximising Your Accident Insurance Benefits

Filing a claim is usually straightforward. You will typically need to provide:

- Proof of the Accident: Police report, medical records.

- Proof of Injury: Doctor’s diagnosis, medical bills.

- Policy Information: Your policy number and details.

Follow the insurance company’s instructions carefully and submit all required documentation promptly. If your claim is denied, don’t give up. You have the right to appeal the decision. Review the policy language carefully to understand why the claim was denied, and gather any additional information that supports your case.

Specific examples of policy language causing confusion: Policies often include ambiguous terms like “reasonable and necessary medical expenses.” Survivors may struggle to understand which treatments qualify and which are excluded.

Legal Rights and Options: If you believe your claim was wrongfully denied or undervalued, consulting with a personal injury attorney is recommended.

The Role of Legal Professionals: An attorney can review your policy, assess the merits of your claim, and negotiate with the insurance company on your behalf. They can also represent you in court if necessary.

Recommendations for Insurance Companies: Beyond offering general compassion, insurance companies can improve their claims processes by providing clear and concise explanations for claim denials, offering mediation services, and investing in training for claims adjusters to better understand the emotional toll of accidents.

Prevention is Key: Reducing Your Risk of Accidents and Insurance Claims

While accident insurance provides a financial safety net, the best way to protect yourself is to prevent accidents in the first place.

- Drive Safely: Obey traffic laws, avoid distractions, and drive defensively.

- Maintain Your Property: Ensure your home and yard are free from hazards that could cause slips and falls.

- Practice Safety at Work: Follow safety protocols and use protective equipment.

- Be Mindful of Your Surroundings: Pay attention to potential hazards and take precautions to avoid accidents.

By taking these steps, you can reduce your risk of accidents and the need to file an insurance claim.

Accident insurance offers valuable financial protection in the face of the unexpected. By understanding its benefits and choosing the right plan, you can secure your finances and focus on recovery after a crash.

I went over this site and I think you have a lot of good info , saved to favorites (:.