So, you’ve filed an insurance claim, jumped through all the hoops, and…denial. It’s frustrating, to say the least. But don’t despair! A denial isn’t the end of the road. It’s often just the starting point for a negotiation. This guide provides actionable steps to turn the tables and secure the settlement you deserve.

Insurance Claim Denied? Know Your Rights and Prepare for Negotiation

Before diving into negotiation, arm yourself with knowledge. Understanding your rights is crucial.

- Review Your Policy: This is non-negotiable. Scrutinise every clause, paying close attention to exclusions, conditions, and limitations. Your policy is the foundation of your claim.

- Understand Denial Reasons: The insurance company must provide a written explanation for the denial. Analyse this explanation carefully. Are their reasons valid based on your policy and the circumstances of the event? If their reasoning is vague or contradictory, it’s a red flag.

- Know UK Law: In the UK, insurance companies are regulated by the Financial Conduct Authority (FCA). The FCA expects insurers to treat customers fairly. Familiarise yourself with the Consumer Rights Act 2015, which provides further protection. For example, if an insurance company breaches its duty of good faith, you might have grounds for a complaint to the Financial Ombudsman Service (FOS). Remember that specific legal provisions vary across the UK regions (England, Scotland, Wales, and Northern Ireland). Each has a separate legal system.

- Statute of Limitations: Be mindful of time limits. There’s a deadline for filing a lawsuit against an insurance company if negotiations fail. This is typically six years from the date of the event, but check the specifics of your policy and consult a legal professional.

- Example: Imagine your home flooded. The insurer denies your claim, citing “lack of maintenance.” If you have documented evidence of regular maintenance (receipts for gutter cleaning, roof inspections, etc.), you can challenge their reason.

Gather Evidence to Solidify Your Insurance Claim Position

A strong case hinges on solid evidence. Don’t rely on your word alone.

- Document Everything: From the initial incident to every interaction with the insurance company, keep detailed records. This includes dates, times, names, phone calls, emails, and reference numbers.

- Collect Supporting Documents: Gather police reports, medical records (if applicable), repair estimates, photographs, videos, witness statements, and any other documentation that strengthens your claim.

- Expert Opinions: If the denial involves technical aspects (e.g., structural damage to a property), consider obtaining an independent expert opinion. A surveyor’s report can be invaluable.

- Estimate Pain and Suffering: Calculating ‘pain and suffering’ is complex, typically arising in personal injury claims. It’s subjective and based on the severity and impact of the injury on your life. One method insurers use is the “multiplier” method, where actual damages (medical bills, lost wages) are multiplied by a factor (usually between 1.5 and 5) depending on the injury’s severity. A more serious injury will likely lead to a higher settlement. Legal assistance is often beneficial when claiming for pain and suffering.

- Example: Following a car accident, you suffer whiplash. You document your medical treatments, physiotherapy sessions, and lost earnings due to being unable to work. This evidence supports your claim not just for direct costs, but also for the impact on your quality of life.

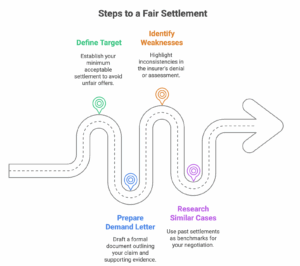

Craft a Compelling Negotiation Strategy for a Fair Settlement

Negotiation is about strategy.

- Determine Your Target and Walk-Away Points: Know the minimum settlement you’re willing to accept. This prevents you from being pressured into accepting an unfair offer.

- Prepare a Written Demand Letter: This formal document outlines your claim, the reasons for the denial, the evidence supporting your claim, and your settlement demand. Keep it professional and factual. Avoid emotional language.

- Focus on Weaknesses in Their Position: Highlight any inconsistencies in the insurer’s denial explanation or flaws in their assessment of your claim.

- Research Similar Cases: See what settlements have been awarded in similar situations. This provides a benchmark for your negotiation.

- Example: You’re claiming for water damage. The insurer offers £2,000, claiming the damage was pre-existing. You obtain a surveyor’s report proving the damage occurred due to a recent storm. You present this report in your demand letter, stating that similar cases of storm damage have resulted in settlements closer to £5,000.

Leverage Policy Language to Your Advantage in Claim Negotiation

Your policy document is your most powerful weapon.

- Identify Ambiguities: Insurance policies can be complex. If there’s ambiguity in the language, argue that it should be interpreted in your favour. Courts often rule against the insurer in cases of ambiguity.

- Highlight Relevant Coverage Clauses: Emphasise clauses that support your claim. Refer to specific sections and definitions in your policy.

- Challenge Exclusion Interpretations: Insurers often rely on exclusions to deny claims. Carefully examine the exclusion language. Does it really apply to your situation? Is there room for interpretation?

- Example: Your policy excludes “damage caused by faulty workmanship.” The insurer denies your claim for a leaky roof, arguing the initial installation was poor. However, you argue that the leak was caused by weather damage to the original, properly installed roof, not the workmanship itself. You cite policy language defining “weather damage” as a covered peril.

Master Communication Techniques for Effective Claim Settlement Negotiations

How you communicate is as important as what you communicate.

- Stay Calm and Professional: Even when frustrated, maintain a respectful tone. Avoid personal attacks or aggressive language.

- Be Clear and Concise: Present your arguments logically and avoid jargon.

- Ask Direct Questions: Don’t let the adjuster evade your questions. Seek clarification on any points you don’t understand.

- Document Every Conversation: Keep a record of every phone call, including the date, time, the adjuster’s name, and a summary of the discussion. Follow up phone calls with written confirmations.

- Take Notes: Note the tone, attitude and any subtle signals that the adjuster is giving you.

- Example: Instead of saying, “You’re deliberately trying to cheat me!”, try, “I’m concerned that the offered settlement doesn’t adequately reflect the extent of the damage and the disruption it has caused. Could you please explain how you arrived at this figure?”

Escalate Your Claim if Initial Negotiation Fails

If you reach a stalemate with the initial adjuster, don’t give up.

- Request a Supervisor: Ask to speak with the adjuster’s supervisor. A fresh pair of eyes may be more receptive to your arguments.

- File a Formal Complaint: If the insurer is unresponsive or acts unfairly, file a formal complaint with their internal complaints department.

- Contact the Financial Ombudsman Service (FOS): The FOS is an independent body that resolves disputes between consumers and financial services providers, including insurance companies. They can investigate your complaint and potentially order the insurer to pay compensation. The FOS is a free service for consumers.

- Example: You’ve repeatedly contacted the adjuster without receiving a satisfactory response. You request to speak with their supervisor, outlining your concerns about the lack of communication and the unfair denial of your claim. You also inform them that you will escalate the matter to the FOS if your concerns are not addressed.

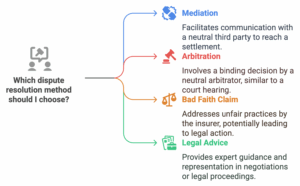

Explore Alternative Dispute Resolution for a Better Settlement

If direct negotiation and escalation fail, consider alternative methods.

- Mediation: A neutral third party helps you and the insurance company reach a mutually agreeable settlement. The mediator doesn’t make a decision, but facilitates communication and guides the negotiation process.

- Arbitration: A neutral arbitrator hears both sides of the case and makes a binding decision. This is a more formal process than mediation, similar to a simplified court hearing. Check if your policy has an arbitration clause.

- Bad Faith Insurance Practices: Insurers are legally obliged to act in good faith. Bad faith includes unreasonably delaying or denying claims, misrepresenting policy language, or failing to conduct a proper investigation. If you believe the insurer has acted in bad faith, this could be grounds for a separate legal action or reporting to the FCA.

- Seek Legal Advice: If you’re unsure about your rights or overwhelmed by the process, consult a solicitor specialising in insurance claims. They can assess your case, provide legal advice, and represent you in negotiations or legal proceedings.

- Example: You and the insurer are unable to agree on a settlement amount. You both agree to mediation. A qualified mediator facilitates a discussion, helping you to understand each other’s perspectives and explore potential compromises, ultimately leading to a settlement that is acceptable to both parties.

Securing a fair insurance settlement after a denial requires persistence, preparation, and a thorough understanding of your rights and the insurance company’s obligations. By following these steps, you can significantly improve your chances of turning the tables and achieving a positive outcome. Remember, knowledge is power. Use it wisely.