When a child suffers an injury due to someone else’s negligence – be it a car accident, a slip and fall, or even medical negligence – a personal injury settlement can provide crucial financial support. But because a minor (someone under 18) can’t manage these funds directly, a guardian assumes a vital role. This isn’t just about depositing a cheque; it’s about protecting a child’s future. Here are three essential duties you absolutely can’t ignore if you’re a guardian managing a minor’s personal injury settlement in the UK.

1. Petitioning the Court: Protecting a Minor’s Settlement

The first, and arguably most crucial, step is securing court approval for the settlement. This isn’t just a formality. The court acts as an independent safeguard, ensuring the settlement is fair and in the child’s best interests.

Imagine, for instance, a 10-year-old involved in a road traffic accident. The settlement offered might seem substantial on the surface, but the court will delve deeper. It will consider the severity of the injuries, the long-term impact on the child’s health and future earning potential, and the likelihood of success had the case gone to trial. They’ll also examine the legal fees to ensure they are reasonable.

To begin, you’ll need to submit a formal application to the court, detailing the circumstances of the injury, the proposed settlement terms, and a plan for how the funds will be managed. This process can vary slightly depending on the specific court, so consulting a solicitor is always advisable. In some cases, the court may appoint a guardian ad litem – an independent individual who represents the child’s best interests during the proceedings. Becoming a guardian ad litem often involves specific training and a background check, ensuring they are equipped to advocate for the child.

Without court approval, the settlement may be deemed invalid, leaving the child vulnerable.

2. Managing Settlement Funds: Investing and Spending Wisely

Once the court approves the settlement, your responsibility shifts to managing the funds prudently. This involves making informed decisions about investing and spending, always with the child’s long-term well-being in mind.

Settlement funds are typically held in a protected account, often managed by the Court Funds Office or a similar body. Accessing these funds requires court approval, ensuring they are used for legitimate expenses that benefit the child.

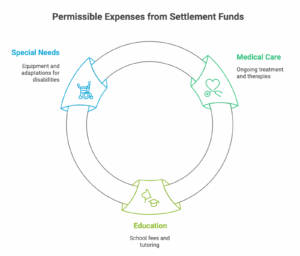

Permissible expenses often include:

- Medical care: Ongoing treatment, therapies, and rehabilitation costs related to the injury.

- Education: School fees, tutoring, and other educational resources.

- Special needs: Equipment, adaptations to the home, or specialized care if the child has a disability.

While spending on immediate needs is important, consider also investing a portion of the funds to ensure long-term financial security. This might involve low-risk investment options that generate income without jeopardizing the capital. A financial advisor specializing in settlements for minors can help you create a suitable investment strategy.

It’s important to be aware that any income generated from the settlement funds might be subject to tax. Seek advice from a tax professional to understand your obligations and ensure compliance with HMRC regulations.

3. Accounting to the Court: Transparency and Accountability

Your final, but no less important, duty is to provide regular accounts to the court, demonstrating how the settlement funds are being managed. This ensures transparency and accountability, protecting the child from potential mismanagement or fraud.

The frequency of accounting will be determined by the court, but it typically involves submitting annual reports detailing all income, expenses, and investments. These reports must be accurate and supported by documentation, such as receipts and bank statements. The court may also conduct audits to verify the accuracy of the accounts.

If you are seeking reimbursement for your own expenses related to managing the funds, you must also include these in your accounting and obtain court approval. Failure to provide accurate and timely accounts can have serious consequences, potentially leading to legal action and removal as guardian.

The Consequences of Neglect

Failing to fulfill these guardian duties can have devastating consequences for the minor. Mismanagement of funds, unauthorized spending, or inadequate accounting can erode the settlement, jeopardizing the child’s future. In severe cases, a guardian may face legal penalties, including fines or even imprisonment.

Where to Find Help

Managing a minor’s personal injury settlement can be complex. Don’t hesitate to seek expert assistance. Legal aid organizations can provide free or low-cost legal advice. Financial advisors can help you create an investment strategy. Social workers can offer support and guidance on accessing resources for children with disabilities.

Remember, your role as a guardian is paramount. By diligently fulfilling these three key duties, you’ll ensure that the settlement truly benefits the child and secures their future well-being.

It’s really a great and useful piece of info. I’m glad that you shared this helpful information with us. Please keep us up to date like this. Thank you for sharing.