A car accident is a frightening experience, especially when your family is involved. In the aftermath, protecting their well-being becomes your top priority. This guide outlines crucial steps to take regarding insurance and medical care, helping you navigate this challenging time.

1. After an Auto Accident: Prioritizing Your Family’s Well-being

Immediately after a collision, your focus should be on safety. Check everyone in the vehicle for injuries. Even if they seem fine, adrenaline can mask pain. Move to a safe location away from traffic, and call 911 to report the accident and request medical assistance if needed. Remember, your family’s health and safety are paramount.

2. Understanding Your Auto Insurance Policy After a Family Car Accident

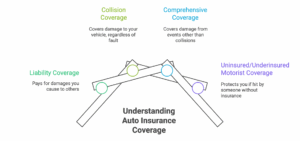

Familiarize yourself with your auto insurance policy before an accident. Understand your coverage levels for:

- Liability Coverage: Pays for damages you cause to others.

- Collision Coverage: Covers damage to your vehicle, regardless of fault.

- Comprehensive Coverage: Covers damage from events other than collisions (e.g., theft, weather).

- Uninsured/Underinsured Motorist Coverage: Protects you if you’re hit by someone without insurance or with insufficient coverage. This is vital as studies show that in 2021, 12.6% of drivers were uninsured.

Knowing these details will streamline the claims process.

3. Seeking Immediate Medical Attention for Your Family After a Car Accident

Even minor-seeming symptoms warrant a medical evaluation. Whiplash, concussions, and internal injuries might not be immediately apparent. Document every symptom, no matter how small. Early diagnosis and treatment are crucial for a full recovery and can strengthen any future insurance claim. If your children are involved, ensure they are examined by a pediatrician experienced in handling injuries from auto accidents.

4. Documenting the Auto Accident: Essential Steps for Insurance Claims and Medical Records

Thorough documentation is key. At the scene, if possible:

- Take photos of the damage to all vehicles, the accident scene, and any visible injuries.

- Exchange information with the other driver(s), including insurance details and contact information.

- Obtain the police report number.

After seeking medical attention, keep meticulous records of all doctor visits, treatments, and medical bills. Start a file to organize all accident-related documents.

5. Navigating Insurance Claims and Medical Bills After the Accident: A Family Guide

Contact your insurance company promptly to report the accident. Be factual and avoid admitting fault. Provide them with all the information you’ve gathered. Remember, insurance adjusters work for the company, not for you. Be polite but firm, and don’t settle quickly. Consult with an attorney if you feel pressured. Keep a detailed log of all communications with the insurance company.

6. Long-Term Medical Care and Rehabilitation: Supporting Your Family’s Recovery

Some injuries require ongoing care, such as physical therapy or counseling. Ensure your family receives the support they need. Document their progress and any ongoing limitations. This documentation is essential for potential settlements.

7. Legal Considerations and Protecting Your Family’s Rights After an Auto Accident

Consider consulting with a personal injury attorney, especially if there are serious injuries or disputes with the insurance company. An attorney can advise you on your rights, negotiate with the insurance company, and represent you in court if necessary. They can also help you understand your options regarding compensation for medical expenses, lost wages, and pain and suffering.

In the long run, the best protection is prevention. Promote safe driving habits within your family: avoid distractions, obey traffic laws, and always be aware of your surroundings.